Inflation Retreats from Late-Summer Highs, Nears Fed Target

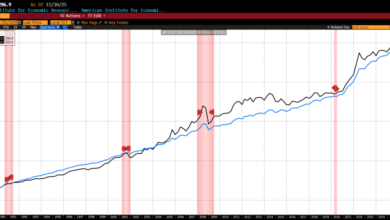

Inflation was lower than expected in November, the Bureau of Labor Statistics (BLS) reported yesterday, in the first official inflation release since October following the extended government shutdown earlier this fall. Over the two months from September to November, the consumer price index (CPI) rose 0.2 percent, down from a 0.3 percent increase in September alone. On a year-over-year basis, headline inflation edged down to 2.7 percent in November from 3.0 percent in September.

Core inflation, which excludes food and energy prices, also rose 0.2 percent over the two-month period, unchanged from September. Core inflation, measured year-over-year, eased to 2.6 percent in November from 3.0 percent in September.

Energy prices were the main driver of inflation over the period, rising 1.1 percent. Food prices also increased modestly, up 0.1 percent, along with prices for household furnishings and operations, communication, and personal care. By contrast, prices for lodging away from home, recreation, and apparel declined.

Tariffs continue to put upward pressure on prices, but their effect appears to be easing, consistent with Federal Reserve Chair Powell’s view that tariffs are likely to result in a one-time increase in the price level. Combining September’s 0.3 percent increase with the modest rise in prices over October and November implies inflation is running at roughly a two-percent annual rate late in the period, though the absence of October data warrants caution.

Recent core CPI data tell a similar story. Core prices rose 0.2 percent in September and increased just 0.2 percent over the two months from September to November, implying a slower pace late in the period.

Taken together, these readings mark a notable shift from the late-summer pattern. In the July–September data, inflation was running at roughly a 0.3 percent monthly pace — equivalent to an annual rate near 3.7 percent — well above what the year-over-year figures suggested at the time. The most recent readings, by contrast, indicate a materially slower pace of price increases, with both headline and core inflation now running much closer to the Fed’s two-percent target, though again, the lack of October data complicates this assessment.

Although the Federal Reserve officially targets the personal consumption expenditures price index (PCEPI), CPI data remain a timely and relevant gauge for policymakers. The two measures generally track one another closely, though CPI tends to run somewhat higher than PCE inflation. As a result, the latest CPI readings provide a useful — if slightly overstated — signal of the inflation environment facing Fed officials as they assess the stance of policy.

Although the recent data suggest that inflation may be easing, the BLS relied on certain methodological assumptions when calculating the November CPI to account for the missing October data. Some analysts have raised concerns that those assumptions may have temporarily biased measured inflation downward. If that is the case, the apparent slowdown in inflation may be due to measurement error rather than a genuine change in the underlying momentum.

Still, financial markets appear to be interpreting the data favorably. Major stock indices rose and bond yields fell following the release. While the CME Group’s FedWatch tool suggests that markets expect the Federal Reserve to hold rates steady at its next meeting, the relative likelihood of a rate cut ticked up modestly after the November CPI report. That shift is consistent with the view that inflation is moving closer to target and lends support to Chair Powell’s recent claim that monetary policy is close to neutral.

Despite the uncertainty surrounding the data, the November CPI report is welcome news on the inflation front. After remaining stubbornly elevated for several years, inflation now seems to be moving back toward target. Even so, upcoming releases of the personal consumption expenditures price index and next month’s CPI should clarify whether the apparent cooling reflects a genuine slowdown in price increases or a temporary measurement distortion.

The post Inflation Retreats from Late-Summer Highs, Nears Fed Target was first published by the American Institute for Economic Research (AIER), and is republished here with permission. Please support their efforts.