Trump’s Credit Card Rate Cap

On January 9, President Donald Trump called for a 10% cap on credit card interest rates—a drop from the 2025 average of 19.7%. This reflects growing political support within the fringes of both the Republican and Democratic Parties for such anti-market policies. In February 2025, Senators Bernie Sanders and Josh Hawley also introduced legislation mirroring Trump’s proposal.

Supporters of price controls like to blame “greedy” corporations. Trump told reporters that credit card companies “really abused the public.” Unfortunately, his proposal treats symptoms while ignoring the disease, and that will ultimately harm the very consumers it claims to protect.

An interest rate is a price. It reflects fundamental economic realities: the preference between present and future consumption, the risk of default, and the administrative expenses of lending. When the government caps this price below its market level, these underlying realities do not disappear. They are merely hidden from view, making it harder for private agents to plan efficiently and forcing lenders to find other margins of adjustment.

And adjust they will. When Congress capped debit card interchange fees—the transaction fees merchants pay to banks when customers use payment cards—in 2010, banks responded by cutting rewards programs on those cards entirely. Credit card companies facing a rate cap will pursue similar strategies: reducing rewards, increasing annual fees, tightening credit requirements, and lowering credit limits. That companies can adapt does not mean that the interest cap is not costly. Around 68% of the 21 million American families who regularly carry balances would likely see their access to credit curtailed or eliminated under a 10% cap.

Credit card companies essentially provide a zero-interest short-term loan to customers who pay their balance each month. Those who fail to do so often reveal poor financial habits, and higher interest rates serve as the market’s mechanism for pricing this risk. By artificially suppressing rates, Trump’s proposal subsidizes financial irresponsibility at the expense of prudent consumers. Since lenders cannot perfectly distinguish between customers who live within their means and those with unsustainable spending habits, they will respond by raising costs for everyone through higher annual fees, reduced rewards, and stricter qualification standards.

The victims of this redistribution will not be wealthy cardholders with excellent credit. They will be young people without established credit histories and lower-income individuals who, despite their modest means, manage their finances responsibly. A study of Chile’s 2013 rate cap legislation for consumer loans found that the policy’s impact fell hardest on “the youngest, least educated and poorest families.” Another study found that this same policy reduced consumer surplus by 2.5% of average income, with the largest losses concentrated among riskier borrowers. The policy did not make credit cheaper for these groups; it simply excluded them from the market.

The proposed 10% ceiling is particularly reckless given America’s fiscal trajectory. During the COVID-era inflation surge, prices rose by nearly 9% year over year. Should such inflation return—an increasingly plausible scenario given unsustainable deficit spending—a 10% nominal cap would translate to an inflation-adjusted interest rate of just 1%. Lenders would face catastrophic losses, and the credit card market as we know it could collapse.

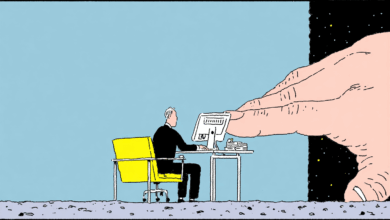

Trump’s proposal is not a serious economic policy. It is a visible gesture designed to signal concern about affordability while doing nothing to address its root causes. Yet every time price controls are attempted, supply dries up, leaving Americans worse off. Interest rate caps are not the politics of affordability; they are the politics of scarcity.

If the Trump administration genuinely wishes to help American consumers, it should focus its energy on deregulation, fostering competitive markets, and confronting the looming fiscal crisis. Adopting anti-market policies typically championed by the far left is not the path to prosperity. It is the road to credit rationing and lower economic growth.

The post Trump’s Credit Card Rate Cap was first published by the Foundation for Economic Education, and is republished here with permission. Please support their efforts.