Medicaid’s Structure Actually Invites Waste and Fraud

Recently, Minnesota and Governor Tim Walz have come under scrutiny for Medicaid Fraud. The debacle received renewed focus on December 1 when Treasury Secretary Scott Bessent posted on X that he had directed the US Treasury to investigate allegations of fraud and that taxpayer dollars were allegedly “diverted to the terrorist organization Al-Shabaab.”

Unfortunately, misuse of Medicaid funds is nothing new. In 2023, the Office of Minnesota Attorney General Keith Ellison charged three individuals as part of a scheme to defraud the Minnesota Medical Assistance (Medicaid) program out of nearly $11 million, the largest Medicaid fraud prosecution in that state’s history. These charges spurred a wider crackdown on Medicaid fraud in the Land of 10,000 Lakes.

What distinguishes the current scandal from background levels of fraud is abundant evidence that “someone was stealing money from the cookie jar and they [state officials] kept refilling it.” This quote, highlighted by Economist Michael F. Cannon, comes from one of the defense attorneys in the fraud case. Cannon then reiterated his insight from 2011: “The three most salient characteristics of Medicare and Medicaid fraud are: It’s brazen, it’s ubiquitous, and it’s other people’s money, so nobody cares.”

This comes at the cost of reducing quality of care and access to care for the poorest Americans. The solution comes from getting government out of healthcare, not by enlarging Medicaid’s “cookie jar,” or by refilling the jar more frequently.

Improper Payments? Fraud? Waste? What’s the Difference?

When federal officials discuss various errors in their program, they choose specific language. Understanding the distinctions in how each term is used helps decipher how a federal program is performing.

In its own findings, the Government Accountability Office (GAO) notes that Medicaid is highly susceptible to “improper payments” with an improper payment rate second only to Medicare. The GAO defines improper payment as “payments that should not have been made or that were made in the incorrect amount; typically they are overpayments.” This is distinct from their definition of fraud, which is “obtaining something of value through willful misrepresentation.” The GAO comments, “While all fraudulent payments are considered improper, not all improper payments are due to fraud.” An improper payment could be an honest mistake on the part of either the citizen receiving Medicaid or the public employees administering the program.

The GAO also distinguishes waste as “when individuals or organizations spend government resources carelessly, extravagantly, or without purpose” and abuse “when someone behaves improperly or unreasonably, or misuses a position or authority.”

Specific allegations or investigations regarding waste or abuse are beyond the scope of this author, but incentives suggest that both are present and widespread among state Medicaid programs.

The Bad News: Medicaid’s Design Makes It Susceptible to Error (Including Fraud)

Medicaid is a joint federal-state program that funds health insurance coverage for America’s poor. The federal government transfers funds to states, which then administer Medicaid programs, with some variations from state to state.

This income threshold to be eligible for Medicaid increased under the expansion of The Affordable Care Act (also known as the ACA or Obamacare). Because ACA enrollees receive more federal dollars than traditional Medicaid, state policymakers are incentivized to prioritize serving more Medicaid expansion enrollees (the slightly less poor) over those in traditional Medicaid (the poorest Americans).

The Centers for Medicare & Medicaid Services (CMS) estimates Medicaid’s improper payments within three categories:

- Managed care: Measured errors in payments states make to private insurance companies that are contracted to deliver Medicaid benefits (known as managed care organizations).

- Fee-for-service: Measured errors in payments states make directly to providers on behalf of fee-for-service beneficiaries, including payments made to ineligible providers.

- Eligibility: Measured errors in state eligibility determinations for both types of Medicaid beneficiaries.

In fiscal year 2024, improper payments in Medicaid were estimated at $31.1 billion — equal to five percent of total Medicaid spending. This highlights a major weakness in the program, whose size and complexity lead to clerical errors and procedural mistakes. Additionally, when states fail to collect the necessary documentation (such as up-to-date income verification), improper payments (including fraud) are more likely to occur.

Saul Zimet recently wrote in The Daily Economy:

The government bureaucrats who kept sending hundreds of millions of dollars to the fraudsters year after year had every indication of what they were enabling, but their incentives were to enable rather than prevent the theft.

Unfortunately, Medicaid’s design encourages state policymakers to maximize transfers. In some instances, that may mean lax oversight of where the money goes and who is eligible to enroll in Medicaid. COVID-19 stimulus funding required states to relax eligibility requirements and accelerate approvals to receive Medicaid: the environment was ripe for accidental improper payments as well as waste and fraud.

Since Medicaid’s inception, state policymakers have taken advantage of accounting gimmicks (such as provider taxes) to maximize the amount federal taxpayers shell out into state programs. The motivation for state officials is clear: increase your spending and have federal taxpayers in other states pay for it. Transfers to state and local governments often come with strings attached — the terms and conditions of receiving the transfers — allowing federal policymakers more influence over state and local spending. Whether or not the use of a provider tax loophole represents a misuse of Medicaid’s framework is the subject of debate. Research from the Paragon Institute highlights areas that, at the very least, require substantial investigation and reform to prevent states from shifting costs to federal taxpayers.

The Worse News: Medicaid’s Errors May Be Worse Than Official Government Estimates

From 2015-2024, the GAO reported $543 billion in improper Medicaid payments. Unfortunately, that may be lower than the actual total. Research from economists Brian Blase and Rachel Greszler found that improper payments during that period are estimated to actually be $1.1 trillion, more than double the GAO’s estimates.

The discrepancy comes from Blase and Greszler’s inclusion of eligibility checks in the audits of improper Medicaid payments, which both the Obama and Biden administrations excluded. The halting of Medicaid enrollment audits is especially concerning because during this same period, many states expanded Medicaid under the ACA and Medicaid saw a record number of enrollees during the pandemic. Blase and Greszler comment, “Eligibility errors of this nature are particularly concerning as it can indicate that individuals are allowed to remain enrolled in the program during times in which they do not qualify, potentially diverting limited resources that could otherwise be invested in better serving vulnerable populations.”

Blase and Greszler’s research raises serious concerns about Minnesota. Is the fraud being investigated just the tip of the iceberg?

The Solution: Get Government Out of Healthcare

In addition to the improper payment rate of Medicare and Medicaid (and the disincentive to investigate what becomes of ‘other people’s money’): fraud risks are being investigated in the other portion of the ACA: the premium tax credits paid from the US Treasury to an insurance company to cover an enrollee of an ACA exchange health insurance plan.

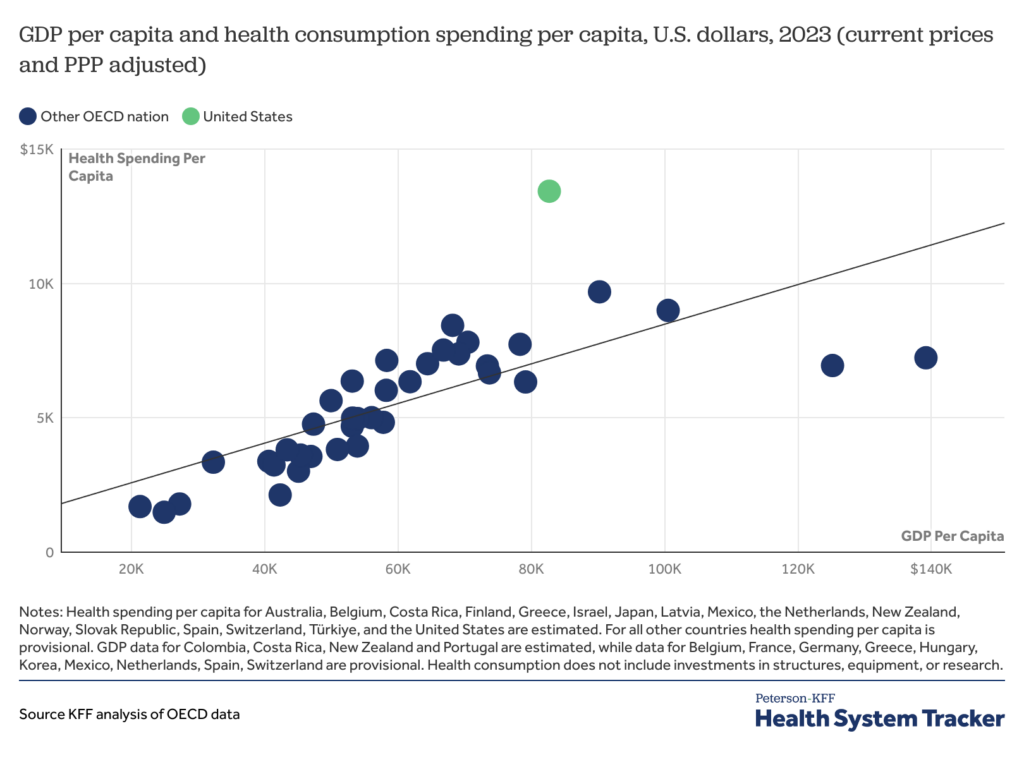

Healthcare is also the single largest category of the federal budget, with about 26 cents of every dollar spent going to various healthcare programs, which are also the single largest item on most state budgets. Not by accident is healthcare highly regulated at both the federal and state levels. Federal and state tax codes incentivize working Americans to purchase health insurance through an employer, leaving little room for insurance offered through civil society and voluntary contracting. There’s a lot unknown in health care, but one thing is clear: government encroachment is not helping.

Healthcare, nearly twenty percent of the US economy and growing, is in desperate need of reform. Rolling back regulations on insurance offerings, the healthcare profession, and innovation, as well as reforming the tax code and spending to encourage consumer-driven choice will encourage competition, lower costs, and empower patients.

Greater consumer choice — and less reliance on distant federal programs — will help reduce the fraud endemic in government healthcare.

The post Medicaid's Structure Actually Invites Waste and Fraud was first published by the American Institute for Economic Research (AIER), and is republished here with permission. Please support their efforts.