Business Conditions Monthly: October Showed Slowing Inflation, Waning Momentum

As this report goes to press, 14 of the 24 components of the Business Conditions Monthly lack published data beginning in September or October 2025. Where updates have occurred, releases are often incomplete and may reflect imputation or other estimation methods rather than finalized observations. Based on current agency release estimates, the earliest realistic timeframe for fully restoring the BCM is early 2026, once a complete and continuous post-shutdown data set becomes available.

Discussion, November — December 2025

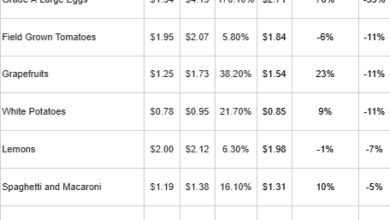

Recent inflation data from both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) deflator point to a broad deceleration in price pressures, even as measurement issues complicate interpretation. Averaged across October and November, headline CPI rose just 0.10 percent per month and core CPI only 0.08 percent, pulling year-over-year inflation down to 2.7 percent and core inflation to 2.6 percent by November. Price declines were widespread across tariff-exposed goods (apparel, electronics, toys, and recreational items) suggesting that earlier tariff pass-through is fading and that discounting tied to holiday promotions is now dominant. Food inflation slowed sharply, with grocery prices falling modestly and egg prices dropping by double digits over two months. Core services inflation also eased markedly, led by slower shelter costs and outright declines in discretionary categories such as hotels, airfares, and recreation, consistent with softer consumer demand around the government shutdown. On a three-month annualized basis, more than half of the CPI basket is now running below the Federal Reserve’s two-percent target, indicating that inflation momentum is waning even beyond a few volatile categories.

At the same time, the Fed’s preferred PCE measure shows a slower, but still incomplete, return to price stability. Core PCE inflation eased modestly in September to 2.8 percent year over year, with one- and three-month annualized rates drifting lower as service-sector inflation, particularly financial services and housing-related costs, moderated. Supercore inflation, which strips out housing, also slowed, reinforcing the signal that underlying service prices are cooling. Importantly, this disinflation is occurring alongside a loss of demand momentum: real personal spending stalled in September, goods spending fell outright, and the personal savings rate remained historically low, suggesting limited consumer capacity to absorb renewed price increases. While inflation remains above the Fed’s comfort zone and some CPI components, especially the perennially-confounding shelter component, are noisy due to data gaps and imputation following the shutdown, the combined CPI and PCE evidence points to a cooling inflation backdrop paired with softening real activity. That mix strengthens the case for policy easing ahead, with inflation trends increasingly aligned with a gradual path toward rate cuts rather than renewed tightening.

The finally-released labor market data for October and November point to a sharper-than-expected slowdown, largely validating the Federal Reserve’s December rate cut and strengthening the case for further easing ahead. Headline nonfarm payrolls fell by 105,000 in October and rose only 64,000 in November, with much of October’s decline driven by a one-time drop in federal employment as deferred-resignation workers rolled off payrolls following the government shutdown. Private-sector job growth remained positive but modest, averaging roughly 75,000 over the past three months, and was narrowly concentrated in health care, education, and construction tied to data-center and AI-related investment. Most other industries shed jobs in both months. The unemployment rate rose to 4.56 percent in November, driven mainly by workers re-entering the labor force and an increase in temporary layoffs, conditions that, if October household data had been collected, could plausibly have triggered the Sahm Rule recession indicator. Taken together, the data suggest a labor market that is no longer broadly expanding and is increasingly dependent on a small group of sectors for job creation.

At the same time, secondary indicators point to cooling momentum rather than outright collapse. Initial and continuing jobless claims remain relatively low, signaling limited layoffs, while aggregate labor income continued to grow modestly, supported more by longer average workweeks than by wage gains, which slowed sharply in November. However, sentiment measures weakened: consumer perceptions of job availability deteriorated during the shutdown period, and surveys of chief financial officers point to restrained hiring plans heading into 2026. Against this backdrop of softer employment growth, rising unemployment, and narrowing hiring breadth, Bloomberg Economics now expects roughly 100 basis points of Federal Reserve rate cuts in 2026. The overall picture is one of a labor market losing resilience and breadth, reinforcing the Fed’s pivot toward accommodation even as outright recession signals remain just below formal thresholds.

US manufacturing conditions remained in contraction in November, highlighting weakening demand and labor utilization even as output and input prices moved in opposing directions. The ISM Manufacturing PMI slipped to 48.2, while the employment sub-index fell sharply to 44.0, signaling continued job losses despite earlier indications of stabilization in regional surveys. New orders declined at a faster pace and order backlogs shrank, pointing to a thin pipeline of future demand, while export orders improved only modestly. Production briefly returned to expansion and inventory destocking slowed, suggesting firms adjusted operations even as demand softened — an imbalance unlikely to persist if orders remain weak. Input costs accelerated, driven by higher steel and aluminum prices and tariff-related pressures spreading through supply chains. Faster supplier deliveries weighed on the headline index, though this signal is distorted by trade-policy shifts rather than demand strength. Overall, the manufacturing data present a worrisome mix of softening demand and employment alongside cost pressures, conditions likely to keep policymakers focused on growth risks rather than near-term inflation noise.

In contrast, services activity expanded at a solid but unspectacular pace in November as projects restarted following the government reopening and firms pushed through year-end work. The ISM Services index rose to 52.6, beating expectations, with business activity improving and new orders remaining in expansion, albeit at a slower rate than in October. Respondents cited still-elevated capital project activity, providing near-term support, but labor conditions remained weak, with the employment index stuck in contraction as hiring stayed cautious. Pricing pressures eased from October’s peak, though the prices-paid index remained elevated, reflecting ongoing tariff-related uncertainty and inconsistent supplier pricing. Service-sector commentary remained uneasy, emphasizing difficulties in sourcing and planning amid trade-policy volatility. Taken together, services are holding up better than goods, supported by backlog clearing and capital spending, but fragile hiring and persistent tariff uncertainty point to steady rather than accelerating growth, reinforcing expectations for a more accommodative policy stance.

US consumer sentiment improved modestly in December but remains deeply depressed by historical standards, reflecting persistent affordability pressures and growing anxiety about the labor market. The University of Michigan’s sentiment index rose to 52.9, below expectations and nearly 30 percent lower than a year earlier, while the current-conditions gauge fell to a record low. Consumers reported the weakest buying conditions on record for big-ticket items, underscoring how high prices and borrowing costs continue to weigh on household decision-making even as inflation has cooled. Although expectations improved slightly and near-term inflation expectations eased to 4.2 percent, nearly two-thirds of respondents still expect unemployment to rise over the next year. That concern is grounded in reality: payroll growth has been sluggish, the unemployment rate has climbed to 4.6 percent, and economists expect labor-market improvement to be limited in 2026. While Federal Reserve rate cuts are intended to support employment and spending, divided policymakers and lingering cost-of-living stress leave consumers cautious, posing a downside risk to household demand that has so far remained resilient.

Sentiment among small business owners and entrepreneurs presents a more conflicted picture. Headline optimism has improved, but underlying financial stress is mounting. The National Federation of Independent Business (NFIB) Optimism Index rose to a three-month high in November, driven by a sharp increase in sales expectations and a pickup in hiring plans, with nearly one-fifth of owners expecting to add jobs. At the same time, inflation pressures are intensifying at the firm level: more than one-third of small businesses reported raising prices, the highest share since early 2023, and inflation ranks just behind labor quality as their top concern. Beyond surveys, balance-sheet strain is becoming more visible. Small-business bankruptcies under Subchapter V are up nine percent this year, loan delinquencies have climbed to multiyear highs, and owners report being squeezed by high interest rates, tariff-related input costs, and increasingly price-sensitive customers. This divergence — relative optimism in forward-looking surveys alongside rising defaults and bankruptcies — highlights the growing gap between entrepreneurial sentiment and operating reality, especially compared with large public companies that continue to post strong earnings results.

US retail spending stalled in October, with headline sales flat after a modestly revised September gain, largely reflecting a sharp pullback in auto purchases following the Sept. 30 expiration of federal electric-vehicle tax credits. Motor vehicle and auto parts sales fell about 1.6 percent, subtracting roughly 30 basis points from overall retail activity, while gasoline sales also weighed modestly on the headline. Excluding autos and gasoline, however, underlying demand was firmer: core retail sales rose about 0.45 percent, and the retail control group — which feeds directly into GDP — jumped a robust 0.8 percent. Consumers continued to prioritize value, driving strong gains in online sales, clothing, furniture, electronics, and other discretionary goods, aided by promotions and early holiday discounting. At the same time, spending at restaurants and bars, which remains a key proxy for discretionary services consumption fell 0.4 percent: consistent with growing sensitivity to high prices and softer labor-market conditions. Overall, the delayed October data suggest the government shutdown had little direct impact on spending, but they also reveal a more selective consumer: households are still spending, particularly on discounted goods and e-commerce, yet pulling back in interest-sensitive categories and discretionary services. Job growth is slowing, unemployment is rising, and affordability pressures persist heading into the critical holiday season.

US industrial production edged up just 0.1 percent in September, but the underlying details point to a softer manufacturing backdrop than the headline suggests. Overall manufacturing output was flat, with gains in business equipment and materials merely offsetting a broad decline in consumer goods production. Consumer goods output fell 0.6 percent, led by a sharp 1.7 percent drop in durable goods as vehicle production was weighed down by supply-chain disruptions tied to shifting trade relationships. Business equipment production rose, supported in part by a rebound in aerospace output following intermittent labor disruptions, but this strength was not enough to lift the factory sector as a whole. Instead, nearly all of the month’s increase in total industrial production came from a 1.1 percent surge in utilities output, masking weakness elsewhere. Taken together, the report suggests that demand-sensitive manufacturing activity remains under pressure, particularly in autos and consumer durables, even as headline production was temporarily boosted by volatile utilities data. The combined October through November 2025 industrial production and capacity utilization reports will be released on December 23.

The latest Beige Book portrays a US economy that is broadly flat to slightly softer, with activity little changed across most regions and pockets of modest weakness outweighing limited areas of growth. Consumer spending continued to slow, particularly at the lower end of the income spectrum, while higher-income households remained more resilient; auto sales weakened further following the expiration of electric-vehicle tax credits, and discretionary spending showed signs of caution amid lingering uncertainty from the government shutdown. Manufacturing activity improved modestly in several regions, helped in some cases by investment linked to data centers and AI, but tariff uncertainty remained a persistent headwind. Nonfinancial services revenues were generally flat to down, residential construction softened in parts of the country, and commercial real estate showed only tentative improvement. Agriculture and energy conditions were largely stable but constrained by low commodity prices, while community organizations reported rising demand for food assistance tied to disruptions in public benefits. Overall outlooks were little changed, though contacts increasingly cited downside risks to growth in coming months.

Labor markets showed mild cooling rather than abrupt deterioration, with employment edging lower as firms relied more on hiring freezes, attrition, and adjustments to hours worked rather than widespread layoffs. Employers reported improved labor availability, though shortages persisted in select skilled occupations and in areas reliant on immigrant labor, while some firms noted that artificial intelligence reduced demand for entry-level hiring. Wage growth remained modest overall, with pockets of firmer pressure in sectors such as manufacturing, construction, and health care, compounded by rising health insurance costs. Price pressures stayed moderate but uneven: input costs rose broadly, driven in part by tariffs and higher expenses for insurance, utilities, technology, and health care, while weak demand and delayed tariff implementation held down prices for some materials. Firms’ ability to pass through higher costs varied widely, leading to margin compression in some industries, and forward-looking price plans remained mixed. Taken together, the report depicts an economy losing momentum at the margins, with softer demand, easing labor tightness, and persistent but contained inflation pressures shaping a cautious business outlook.

Recent US data depict an economy that is cooling unevenly beneath the surface, even as policy stimulus and financial conditions remain unusually supportive. Inflation momentum has clearly faded: CPI and PCE measures show broad-based disinflation across goods and services, with tariff-exposed categories now experiencing outright price declines and core services inflation easing as discretionary demand softens. More than half of the CPI basket is running below a two-percent annualized pace, and real consumer spending has stalled, signaling limited capacity for households to absorb renewed price pressures. At the same time, labor-market conditions have deteriorated more than expected, with payroll growth slowing sharply, unemployment rising toward levels that would normally raise recession alarms, and job creation increasingly concentrated in a narrow set of sectors such as health care and AI-linked construction. Manufacturing remains in contraction, new orders are weakening, and consumer-facing activity (ranging from retail to restaurants) recording growing selectivity and price sensitivity. Against this backdrop, the Federal Reserve has pivoted decisively toward accommodation, not only through rate cuts but via renewed balance-sheet expansion that amounts to a form of “quantitative easing lite,” reinforcing easier financial conditions even as real momentum fades.

What complicates the outlook is an extraordinary degree of policy uncertainty layered atop late-cycle asset valuations. Fiscal stimulus remains substantial, combining new tax cuts under the so-called Big Beautiful Bill with the ongoing flow of spending authorized under Biden-era packages, helping sustain corporate revenues and household cash flow despite weakening fundamentals. Equity markets sit at lofty levels supported by still-solid earnings, yet forward expectations, particularly where prospects for artificial intelligence innovation are considered, remain uncertain. Meanwhile, unresolved legal and geopolitical risks loom large: uncertainty surrounding a potential Supreme Court ruling on IEEPA authority clouds the durability of current tariff regimes, while proposals associated with the Mar-a-Lago Accord, including restructuring US Treasuries and deliberately weakening the dollar, continue to inject uncertainty at levels not seen in decades into global capital markets.

Taken together, the past year can be characterized as one of slowing inflation but eroding economic breadth held aloft by policy support. The year ahead points to cautious, conditional optimism largely dependent on whether easing financial conditions can offset policy uncertainty without reigniting inflation or destabilizing confidence.

The post Business Conditions Monthly: October Showed Slowing Inflation, Waning Momentum was first published by the American Institute for Economic Research (AIER), and is republished here with permission. Please support their efforts.