Why the Erosion of Central Bank Independence Matters

Central bank independence isn’t just wonky economic theory. It’s a stabilizing force in fiat money-using economies. When shortsighted politicians control monetary policy, the public suffers. Consider that with a 10 percent inflation rate, a $50,000 salary loses $5,000 in purchasing power annually—that’s a month’s rent, a year of groceries, or your child’s college savings evaporating.

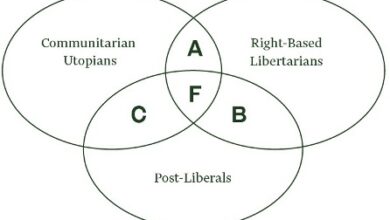

Yet this crucial principle, once taken for granted in advanced democracies, is under threat from the left and right in the United States. Central bank independence prevents politicians from using monetary policy as a tool for short-term political gain at the expense of long-term economic stability. Politicians face election cycles every two to six years and have strong incentives to boost economic activity before elections—even if doing so creates problems later. If central bankers are insulated from these short-term political pressures, they can make the tough decisions needed to maintain price stability and economic health over the long run.

The current White House has taken various steps to undermine Fed independence. President Trump has repeatedly pressured Federal Reserve Chair Jerome Powell to cut interest rates and considered firing Powell when he refused. Trump appears to have pressured Michael Barr to step down as Vice Chair for Supervision and is currently trying to remove Governor Lisa Cook from the Fed Board for cause. In doing so, Trump demonstrates a fundamental misunderstanding of the Fed’s structure and independence.

Consider the rushed nomination of Stephen Miran to the Fed’s Board of Governors just before the last FOMC meeting. Rather than resigning from Trump’s Council of Economic Advisers, Miran opted to join the Fed while on unpaid leave from the White House. That looks like a clear violation of central bank independence, which raises some uncomfortable questions. Will Miran report behind-closed-doors Fed discussions back to the White House? Will Miran make monetary policy decisions based on his analysis of the available economic data or the political priorities of the President? How can markets trust that monetary policy will be conducted without political influence when a sitting Governor has the option to return to the White House in January?

The most dangerous threat to independence comes from what economists call fiscal dominance, where the central bank is forced to prioritize financing the government’s spending over its primary goal of controlling inflation. When governments “print money” to cover their deficits, they increase the money supply without any corresponding increase in economic demand for that money. The result is not just inflation, but very high rates of inflation. In 2023, inflation in Argentina spiked to 211 percent. That’s what life is like with fiscal dominance.

The Federal Reserve’s independence isn’t a courtesy extended to unelected technocrats. It’s a structural safeguard designed to protect families from the runaway inflation that has plagued other nations throughout history. It isn’t an abstract policy dispute. Central bank independence is the foundation that keeps your grocery bill stable and your savings secure.

Recent political pressures on Fed leadership threaten to undermine decades of hard-won credibility that have helped keep inflation in check and financial markets stable. It would take years to rebuild that credibility, if lost, and would likely require painful economic adjustments during the rebuilding phase. In the American case, it would also risk dedollarization. The US enjoys the exorbitant privilege of issuing the global reserve currency because the rest of the world expects the Federal Reserve will conduct policy reasonably well. That expectation—and, hence, the ability to issue the global reserve currency—depends on the Fed’s independence.

The lesson from around the world is clear: countries that politicize their central banks pay a steep price. America has not avoided that fate by accident. It has avoided that fate by design. Preserving central bank independence isn’t just good policy. It’s essential for promoting American prosperity.

The post Why the Erosion of Central Bank Independence Matters was first published by the American Institute for Economic Research (AIER), and is republished here with permission. Please support their efforts.